What is the hallmark and primary sin of the rich? Conspicuous consumption. Look at the dollars they spend on toys, vacations, dining, private transportation, and special services that the vast majority of Americans have no hope of ever enjoying. Because wealth may not be “income”, a rich man who didn’t like taxes could choose not to work for years, and still have more and spend more than the guy who has to have two jobs to make ends meet. If a wealthy person choose not work, or not have an income, they could (and some do) get away with paying almost no taxes at all. I know a retired person who managed to get all his money into tax free bonds, and takes home about $400,000 a year in tax free non-reportable money, his only “income” is Social Security, so he pays less in taxes than my just out of school part time employed son pays. This is not “fair”. This person consumes a huge amount of goods and services, gets a disproportionate amount of health care, but because his only “income” is social security, pays minimal taxes.

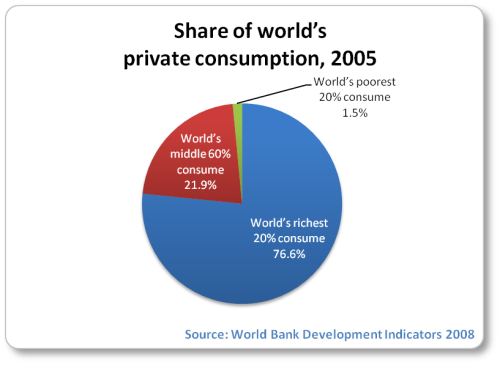

Globalists complain about our consumption society being unsustainable. The United Nations has provided some eye-opening statistics worth noting here:

Today’s consumption is undermining the environmental resource base. It is exacerbating inequalities. And the dynamics of the consumption-poverty-inequality-environment nexus are accelerating. If the trends continue without change — not redistributing from high-income to low-income consumers, not shifting from polluting to cleaner goods and production technologies, not promoting goods that empower poor producers, not shifting priority from consumption for conspicuous display to meeting basic needs — today’s problems of consumption and human development will worsen.

… The real issue is not consumption itself but its patterns and effects.

… Inequalities in consumption are stark.

Globally, the 20% of the world’s people in the highest-income countries account for 86% of total private consumption expenditures — the poorest 20% a minuscule 1.3%.

More specifically, the richest fifth:

Consume 45% of all meat and fish, the poorest fifth 5%

Consume 58% of total energy, the poorest fifth less than 4%

Have 74% of all telephone lines, the poorest fifth 1.5%

Consume 84% of all paper, the poorest fifth 1.1%

Own 87% of the world’s vehicle fleet, the poorest fifth less than 1%

How do we correct both the problem of over consumption, and the rich being able to manipulate tax code to avoid paying their fair share without compromising individual liberties in the United States? If we give ruling elite the power to determine what consumption is good and bad, we run afoul of a great many constitutional protections and give government more power which it always seems to abuse and would destroy personal property rights. Libertarians believe that no person should have the right to decide for others what goods are necessary for living and which aren't, or that luxuries are necessarily wasteful. If others could decide that it would lead to tyranny.

The solution is obvious - Tax consumption not income. Eliminate the ability of government to track who pays what taxes, so that no tax advantage can be purchased, eliminate all exemptions of any kind for the purchase of any services or new goods. The consumption tax would be collected at the point of purchase just like a sales tax. The problem is that poor and most of the middle class must spend virtually all their incomes to survive and thus would be paying taxes on 100% of everything they make, while the rich who can afford to save would only be paying taxes on what they consumed, so thus proportionally wouldn’t pay as much in taxes as the poor.

If consumerism is a problem, and even the middle class is over consuming, then we can address the problem of the poor pay proportionally more in taxes than the rich, and both the rich and middle class over consuming by identifying a methodology where the poor pay no taxes, and the middle class pay less but are still taxed for over consuming, and the rich are soaked for their over consumption. This method could be simply providing for every person the equivalent of what they would have paid in consumption taxes if they had to spend all their income on the necessities of life. Assume the poverty level for a family of four is $30K, and we taxed over consumption at 30%. Rather than figure out what the necessities are or aren’t, just tax all consumption at 30% and return to everybody what they would have paid in taxes consuming just the bare minimum. So a family of four earning $30K per year takes home about $2100 per month after taxes and spends it all every month just surviving. If all they spent was taxed they would pay almost $650 per month in consumption taxes, which would literally destroy that family’s way of life. So the first of every month send them a $750 check to cover their consumption taxes, thus they would be paying zero taxes. $750 because they no longer would be paying taxes on their income and would have all $2500 to spend every month. Even with 30% consumption tax this family with a $750 tax prebate and zero federal taxes from their pay check would have more money every month than they do now.

Since we believe in the rule of law every family of four gets the same $750 per month prebate, whether rich or poor. Now let’s talk about that rich guy John Kerry again that purchased a new dingy (well it was a $1million dollar yacht), and as a new purchase would be subject to the same 30% consumption tax (remember zero exemptions for anything). He would pay $300,000 dollars in taxes for just that single purchase, the $750 prebate he received, same as the poor guy making $30K, compared to what he paid is so small as to not be noticed. Unless the rich wanted to live like poor they would pay hugely more in taxes. Knowing that there is a 30% tax on everything they purchase, their over consumption would be curtailed because anything they spent above and beyond the poverty level would be severely taxed. Want a new car, the tax on a $14,000 30+mpg economy car will be around $4200, want a be excessive and show off how cool you are, the taxes for conspicuous consumption on a $41K

By taxing the consumption at the point of sale rather than wages, we tax those who don’t have a “wage” but have wealth, we tax those who exist in the underground cash society, and we tax those with wealth far more than those without. Conspicuous consumption would decrease. Most importantly by eliminating the politician’s ability to give out tax advantages to the rich and treating everybody the same, we take away a huge incentive we now have for the rich to buy off politicians.

In order for all men to be equal under the law, justice must be blind, and for that to happen, when it comes to taxes, there must be no means to play favorites, and no loopholes to exploit. If all men are treated equal with regard to taxes – not just in the percentage they pay but in the amount they are exempted or ‘prebated’, then all that remains is the individual taking responsibility for his consumptive choices, be they green, frugal, or excessive. This goal reality is far easier achieved than many might think. Nor is it an new concept. Taxing consumption is not a new idea, in fact nearly 100 congressmen have co-sponsored such a bill in the US house of Representatives. It’s called the “Fair Tax”. Read about it at http://www.fairtax.org

No comments:

Post a Comment